Introduction To Market Failure

Benefits and costs

Benefits

Marginal Private Benefit (MPB): The price a consumer is willing to pay to enjoy the benefit of one extra unit of a good. This is demand because it is the price paid. (D=MPB)

Marginal External Benefit (MEB): The negative/positive benefit on external parties (not consumer) by consuming one extra unit of the good.

Marginal Social Benefit (MSB): The benefit on society as a whole, from consuming one extra unit of the good. MSB=MPB+MSB

Costs

Marginal Private Cost: The price paid by producer to produce one extra unit of a good. This is the same as supply because due to law of diminishing returns for the final unit will have a cost equal to the price, to maximize profits.(S=MPC)

Marginal External Cost (MEC): The negative/positive cost to external parties (not producers) by consuming one extra unit.

Marginal social cost (MSC): The cost on society as a whole, form consuming one extra unit of the good. MSC = MPC+MEC

Allocative efficiency

Allocative efficiency is when goods are produced in the way which is socially desirable. More specifically it is the point when the marginal social benefit is the same as the marginal social cost to consumers, thus any more units would create an imbalance. (Point of pareto efficiency). In addition there is enough that there is neither a shortage or surplus.

Four things are achieved at allocative efficiency:

- MSC =MSB (Pareto efficiency)

- D=S

- P = MC (Consumers pay exactly what it costs)

- maximum economic welfare

What is a market failure?

This is when the market fails to achieve allocative efficiency. This occurs when either too much or too little of a good is produced (from society's point of view).

This can be caused by:

- Existence of externalities

- Negative externalities of consumption/production

- Positive externalities of consumption/production

- Lack of public goods

- Common access resources and the threat to sustainability

- Asymmetric information

- Abuse of monopoly power

Existence Of Externalities

What are externalities?

Externalities are when a third party is affected by production or consumption

Positive externalities: This is when are positive marginal external benefits. MSB>MSC

Negative externalities: This is when there are negative marginal external benefits. MSC>MSB

Production externalities: Create a difference between social costs and private benefits. MSC ≠ MPC

Consumption externalities: Create a difference between social benefits and private benefits. MSB ≠ MPB

Negative externalities of consumption

This is when demerit goods, which cause unintended negative effects on a third party, are over consumed. Here there is a negative external benefit, so the social benefit is less than the private benefit. MSB<MPB

Cars, cause negative externalities of consumption, because by driving them we pollute the environment. Therefore, the MSB<MSC, so there is allocative inefficiency.

Demerit goods: Goods with negative externalities of consumption.

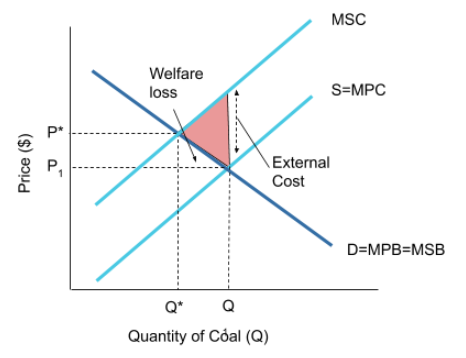

Negative externalities of production

This is when goods or services which cause unintended negative effects on a third party (often the environment), are overproduced. Here there is a negative external cost, so the social cost is greater than the private cost MSC>MPC

A good example could be coal production. This creates air pollution which is harmful to people and the environment, thus is a negative externality of production. As such we are taking efforts to phase out coal plants, to achieve allocative efficiency.

Positive externalities of consumption

This is when merit goods which causes unintended positive effects on a third party, are underconsumed. Here there is a positive external benefit, so the social benefit is greater than the private benefit MSB>MPB.

An example of this is with education. Education is a merit good, because learning allows, people to get better jobs in the future, decreasing unemployment and encouraging economic growth.

Merit goods: Goods with positive externalities of consumption.

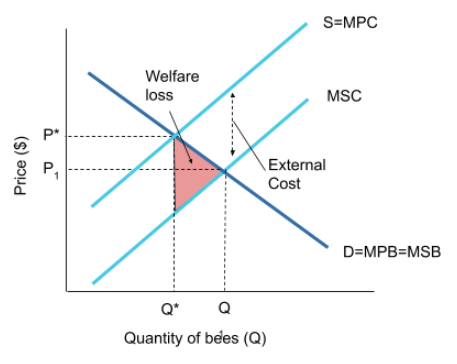

Positive externalities of production

This is when merit goods which cause unintended positive effects on a third party, are underproduced. Here there is a positive external benefit, so the social benefit is greater than the private benefit MSB>MPB.

An example of this is is beekeepers who keep bees for honey. By doing this they are also allowing for pollination of nearby flowers, which was unintended and thus a positive externality of production

Lack Of Public Goods

Public goods: These are goods that, without government intervention, aren't supplied in a free market but are beneficial to society. This is a type of market failure, as the public goods are under-allocated from society's point of view.

Public goods vs private good

Private goods are the opposite of public goods. Private goods are rivalrous and excludable, while public goods are non-excludable and non-rivalrous.

Private goods

- Rivalrous: one person consuming this good reduces the ability of someone else to consume this good. For example, if you buy and sandwich and eat it, no one else can eat that same sandwich (hopefully!).

- Excludable: someone can prevent others from consuming the good once it has been provided. This is a consequence of having to pay for the good to consume it.

Public goods

- Non-excludable: impossible to prevent someone from consuming it once someone else has. For example, a dam for a large river during flood seasons. The local commune may have funded it, but they can't stop the next village down the river from reaping the benefits of their investment.

- Non-rivalrous: if one person consuming it doesn't prevent another from consuming it. Here, the example of the dam applies again. One person using it in the village above doesn't mean the other person can't use it.

Problem

These goods are beneficial to society, but because of the fact that they are non-excludable and non-rivalrous, consumers don't want to buy them, because someone else who hasn't paid can use them. If the demand for the good is low, private companies won't produce them.

Solution

To increase the number of public goods, the government must intervene. As private companies don't supply them, they have two options. They can create an incentive for private companies, buy subsidising the costs. Alternatively, they can pay for the dam to build themselves.

Common Access Resources And Threats To Sustainability

Common access resources: These are resources that are not owned by anyone, do not have a price, and are available to use without payment. They are rivalrous and non-excludable.

Examples of common access resources

Some examples include:

- Fish in open oceans

- Lakes

- Forests

- Mineral water

- Mountains

- Fields

These are rivalrous because by using these resources they become depleted and they are non-excludable because they are open for anyone to take and no one can privatize them.

Threat to sustainability

Since these goods are non-excludable, rivalrous and don't have a pricing mechanism the social benefit greatly outweighs the cost and so these resources become depleted. This means resources like lakes and forests cannot stay sustainable, as everyone uses them, until they are gone.

However if we do the opposite and only focus on the environment then we may not be able to keep up with human needs.

Government responses to threats to sustainability

Solutions to the problem try to prevent the over-consumption of these common access resources. The disadvantage for any of these is the opportunity cost, putting money into doing this as well as the reduction in output.

- Carbon tax: A method of reducing the amount of carbon dioxide emitted from burning fossil fuels by forcing firms to pay a tax per kilogram of carbon dioxide released

- Cap and trade schemes: They are permits issued by the government that give firms the licence to create pollution up to a certain level. Once they are issued, firms can buy, sell and trade them in the market.

- funding for clean technologies: Clean technologies do not deplete common access resources and complementary to goods which do. Funding these goods as positive externalities of consumption and helps stop the depletion. However it is quite expensive and not very effective in the short run.

Need for international cooperation

Government responses to threats to sustainability are limited by the global nature of the problems and the lack of ownership of common access resource thus the only way to solve the problem is with international cooperation.

For example in 2015, in Paris, 105 countries came together to decide to impose a carbon tax, in hopes of preserving the environment. This was necessary because without the agreement a country would have an economic disadvantage if they stop using the common access resource that other countries are using.

Asymmetric Information

Market failure may occur when one party in an economic transaction (either the buyer or the seller) possesses more information than the other party. This is called asymmetric information.

government responses

- Legislation

- Regulation

- Provision of information

Abuse Of Monopoly Power

Monopolies which will be discussed more in market structures can cause loss of welfare and are therefore a cause of market failure.

government responses

- legislation

- Regulation

- Nationalisation

- trade liberalisation